For NGIF Cleantech Ventures, a first of kind venture fund that has captured the confidence and investment dollars of some of Canada’s leading energy companies, we create a financial return through a liquidity event. This event can occur via a Share Purchase (a buyout of an investor’s position by a new investor; an Acquisition (Strategic acquisition by an incumbent who is buying a differentiated technology with a large customer base and great team; or an Initial Public Offering (IPO).

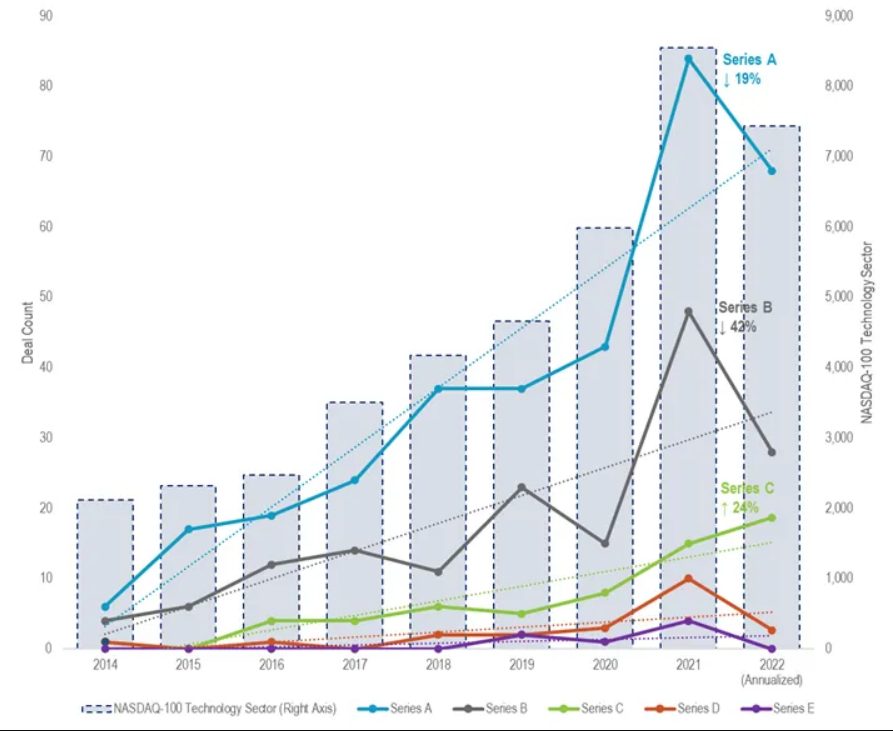

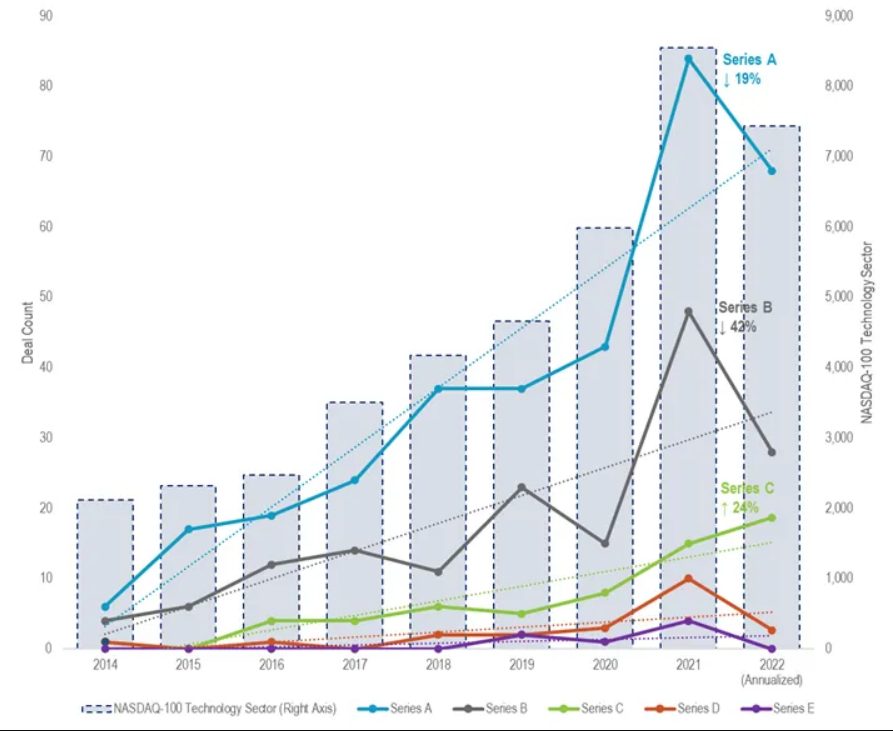

Early stage VC deal count in Canada (2014–2022 YTD) with reported data. Source: Pitchbook data collected on September 20th, 2022.

During an IPO, shares in the private company are sold publicly to retail and institutional investors, which allows venture capital funds to return capital to their limited partners. Therefore, it should come as no surprise that if markets are functioning rationally the closer a company is to its IPO, the stronger the correlation becomes with what is happening in the public markets. If the same type of logic is applied to earlier stage companies (that are years away from being IPO ready) then they should be more insulated from changes in public market behavior. However, during the COVID-19 pandemic markets were behaving anyway but rationally. In particular, the technology sector experienced unpreceded (and somewhat unfounded) increases in valuations over this period. Between 2019 and 2021 the NASDAQ-100 Technology Index climbed by a scarcely believable 83% from 4,666 to 8,551 before beginning a 13% slide back down YTD in 2022. Now that the dust is starting to settle and markets are returning to pre-pandemic levels, we can start to see how these seismic changes in public markets have trickled down to impact venture backed companies at various stages of maturity.

As we noted in our previous insight “War For Talent In A Post Pandemic World” the start up ecosystem has been working in overdrive for the past decade. According to data collected on Pitchbook, the number of venture backed deals in Canada has grown by nearly 350% in the last five years alone (up from 36 in 2016 to 161 in 2021). However, the recent correction in public market equites has caused a sharp departure from this trend over the past nine months. When YTD 2022 data is annualized we estimate that Series A financing rounds will have dropped by 19% Y-o-Y, while we expect the number of Series B rounds to have the largest impact with an estimated 42% reduction. What we found most interesting is that the number of Series C rounds has actually increased by 24% according to our extrapolated data. This trend points to better than expected resiliency for later stage companies than we would have initially thought.

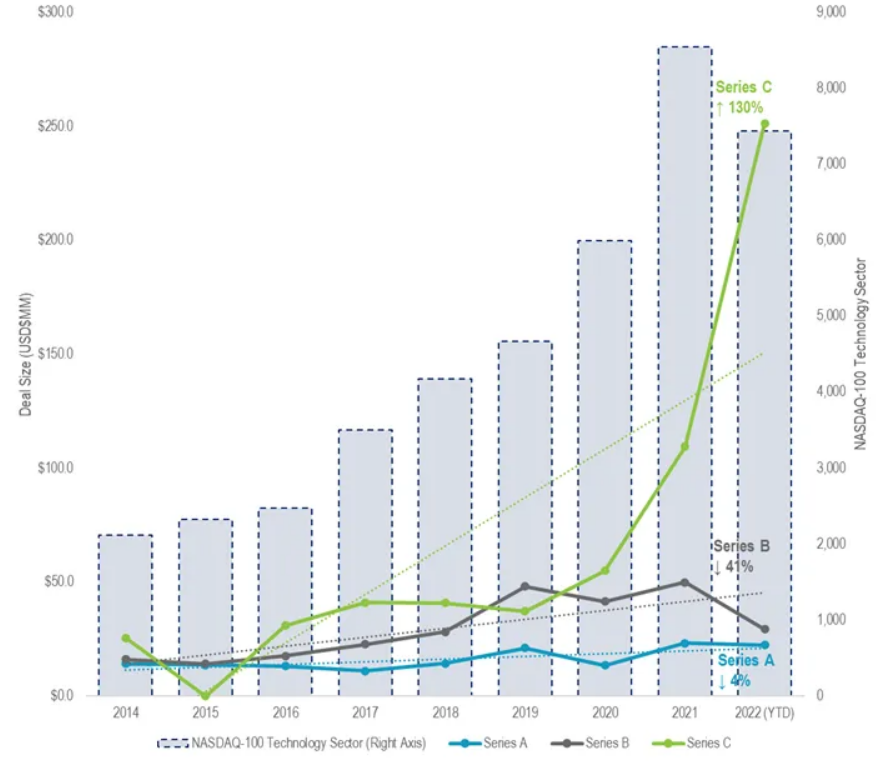

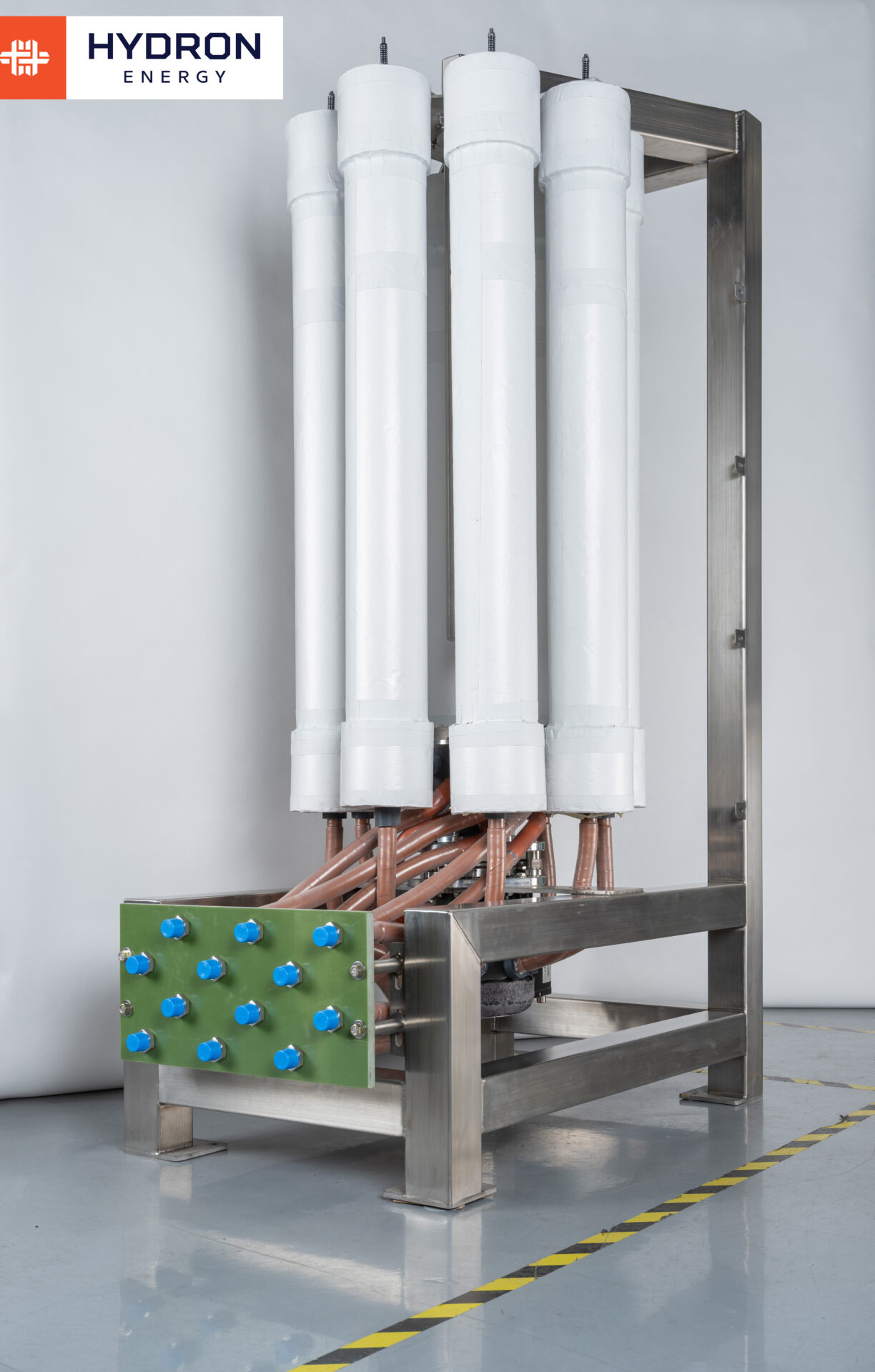

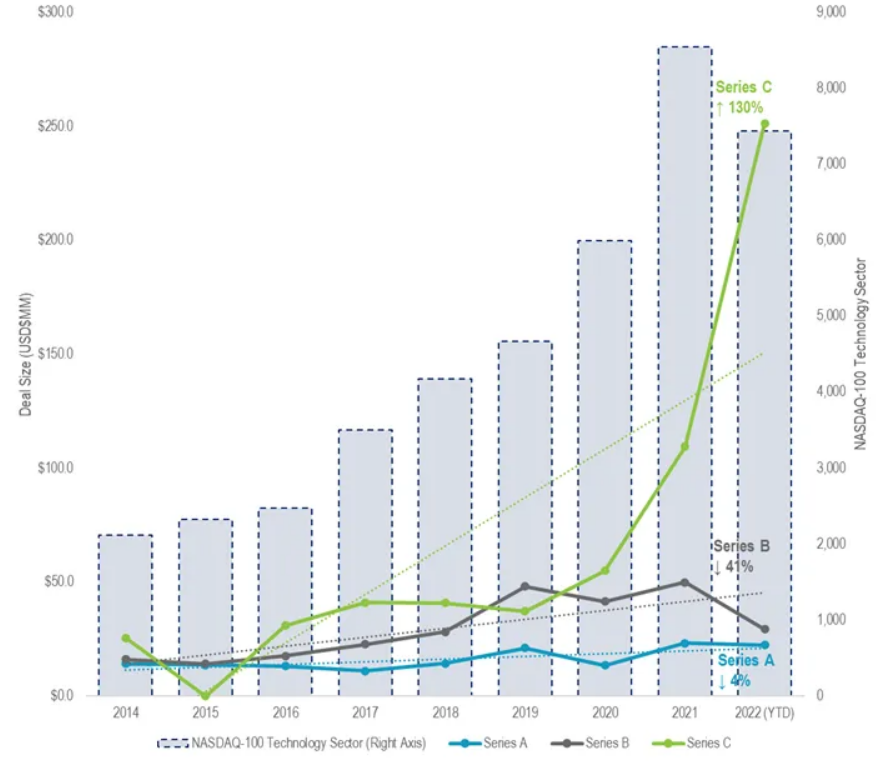

Despite the observable correlation with public market data, the relationship appears to deteriorate when viewed in the context of financing size in the Canadian ecosystem. The average series A round remained fairly consistent from 2021 to 2022 YTD with a modest decline of 4% from USD$23.2MM to USD$22.3MM. Series B rounds experienced the largest impact with a decline of 41% Y-o-Y from USD$49.9MM to USD$29.3MM. Keeping with the theme noted above, Series C rounds experienced an explosive growth of 130% compared to last year with the average round size increasing from USD$109.3 to USD$251.3MM across the 15 deals in 2021 and 19 deals in 2022 that are included in our study. This indicates that later-stage VC backed Canadian companies are still commanding premiums compared to their earlier stage counterparts.

Early stage VC deal size in Canada (2014–2022 YTD) with reported data. Source: Pitchbook data collected on September 20th, 2022.

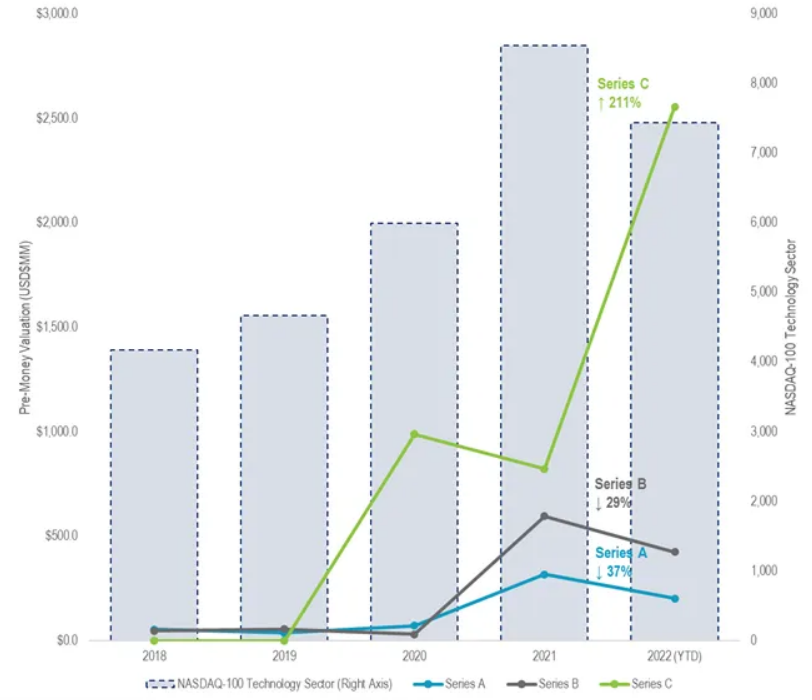

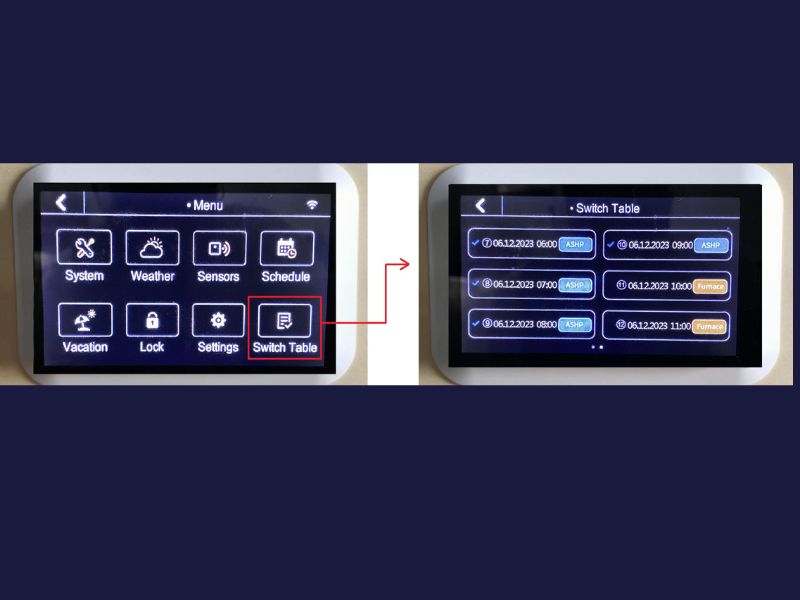

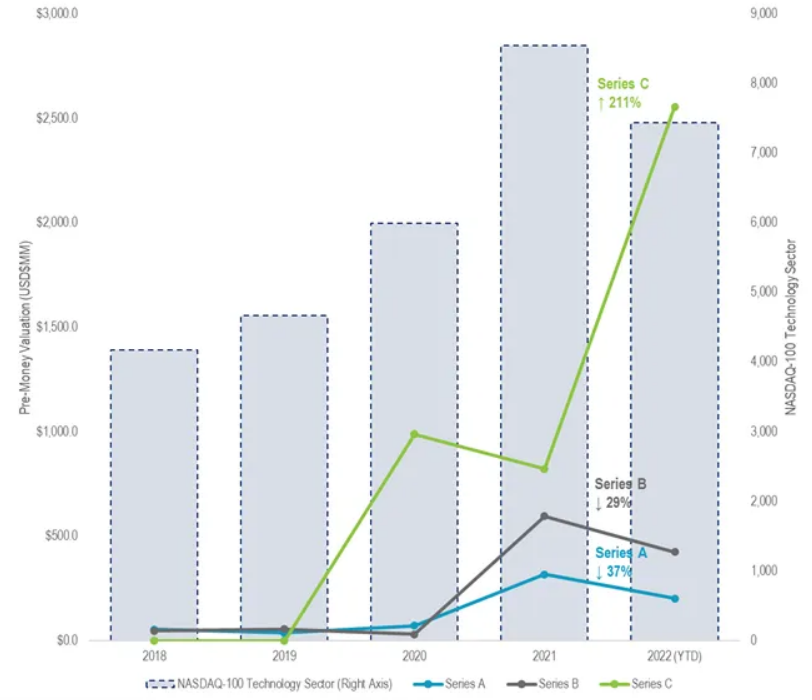

Finally, both Series A and B rounds experienced substantial declines in pre-money valuations between 2021 and 2022 YTD. Pre-money valuations in Series A rounds declined by 37% from USD$317.3MM in 2021 to USD$201.3MM in 2022. Similarly, valuations in Series B rounds declined by 29% from USD$595.8MM to USD$424.0MM in 2022 across the deals included in our study that reported valuation metrics. Series C valuations continued their contrarian momentum and increased by 211% from USD$821.8MM in 2021 to USD$2.6Bn in 2022.

Early stage VC pre-money valuation in Canada (2018–2022 YTD) with reported data. Source: Pitchbook data collected on September 20th, 2022.

From this data on the Canadian ecosystem it is clear that earlier stage companies have been impacted to a far greater extend than we would have previously thought. At NGIF Cleantech Ventures we have advised our portfolio company founders to extend runways as long as possible and reduce discretionary spending in an effort to preserve capital and avoid raising external capital for the next 12–16 months. As the fallout from the public market turmoil trickles down to earlier stage companies, founders need to be prepared to weather the storm or face the risk of a flat round (i.e. raising at the same valuation as the previous round) or a down round (i.e. raising at a valuation below the previous round). While no one is immune to external market conditions, we have been cautioning our portfolio companies that these risk have very real consequences. Down rounds have a profoundly negative impact on the growth trajectory of a company. If external capital is needed desperately to maintain operations, we have been advocating for alternative methods of financing such as bridge loans or convertible notes to help weather the storm.