Canada, as we know, is a fantastic place to call home. It has all the right ingredients for a high quality of life. This assertion was recently confirmed by the Economist Intelligence Unit (“EIU”) 2022 Global Liveability Index. Despite its minimal population footprint (0.5% of global population), Canada held 30% of the top ten most livable cities globally: Calgary (T3), Vancouver (5), and Toronto (8). The EIU ranks 172 cities on various criteria for liveability including stability, healthcare, culture & environment, education, and infrastructure, all of which Canada’s largest cities scored at the top of the field. However, these parameters fail to capture the success of the Canadian start up/scale up ecosystem.

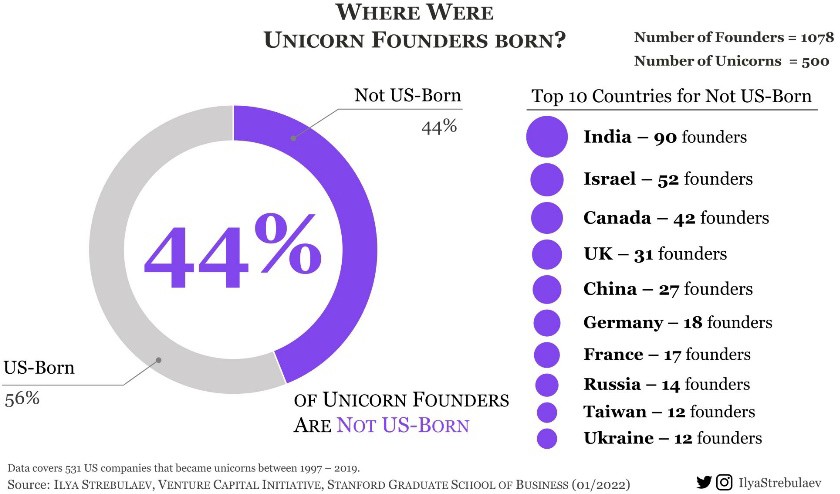

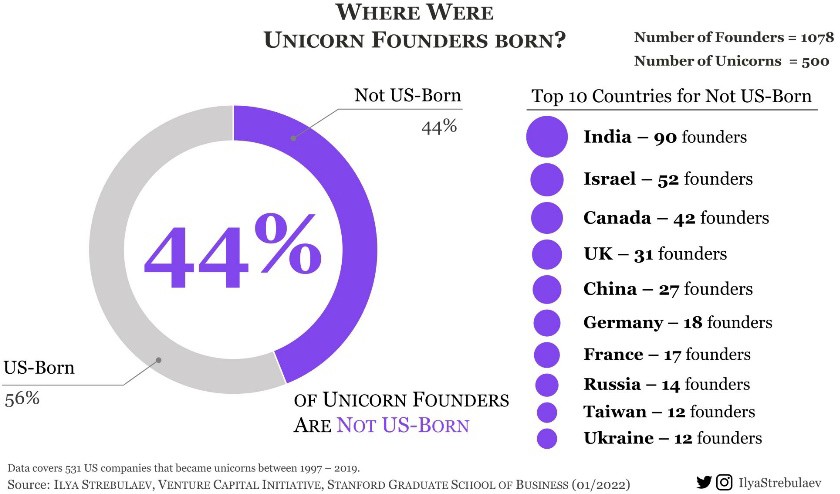

Based on research conducted by Ilya Strebulaev and his team at the Venture Capital Initiative at the Stanford Graduate School of Business, Canada is one of the most dominant jurisdictions outside of the United States for Unicorn company (a private company valued in excess of $1Bn) founders to call home. On a population adjusted basis, the Canadian scale up ecosystem is second only to Israel outside of the US – and for good reason. Canada’s friendly immigration policies, affordable access to post secondary education, and a high standard of living have all contributed to a wave of category defining heavyweights. Just in the past year, Neo Financial, DapperLabs, Clearco, Ada, Clio, Freshbooks, and Visier all joined the Canadian $1Bn club–with several more right on their heels. For years, Canadian start ups were relegated to the second tier of the investment landscape, but we are witnessing firsthand the birth of a new age.

Based on research conducted by Ilya Strebulaev and his team at the Venture Capital Initiative at the Stanford Graduate School of Business, Canada is one of the most dominant jurisdictions outside of the United States for Unicorn company (a private company valued in excess of $1Bn) founders to call home. On a population adjusted basis, the Canadian scale up ecosystem is second only to Israel outside of the US – and for good reason. Canada’s friendly immigration policies, affordable access to post secondary education, and a high standard of living have all contributed to a wave of category defining heavyweights. Just in the past year, Neo Financial, DapperLabs, Clearco, Ada, Clio, Freshbooks, and Visier all joined the Canadian $1Bn club–with several more right on their heels. For years, Canadian start ups were relegated to the second tier of the investment landscape, but we are witnessing firsthand the birth of a new age.

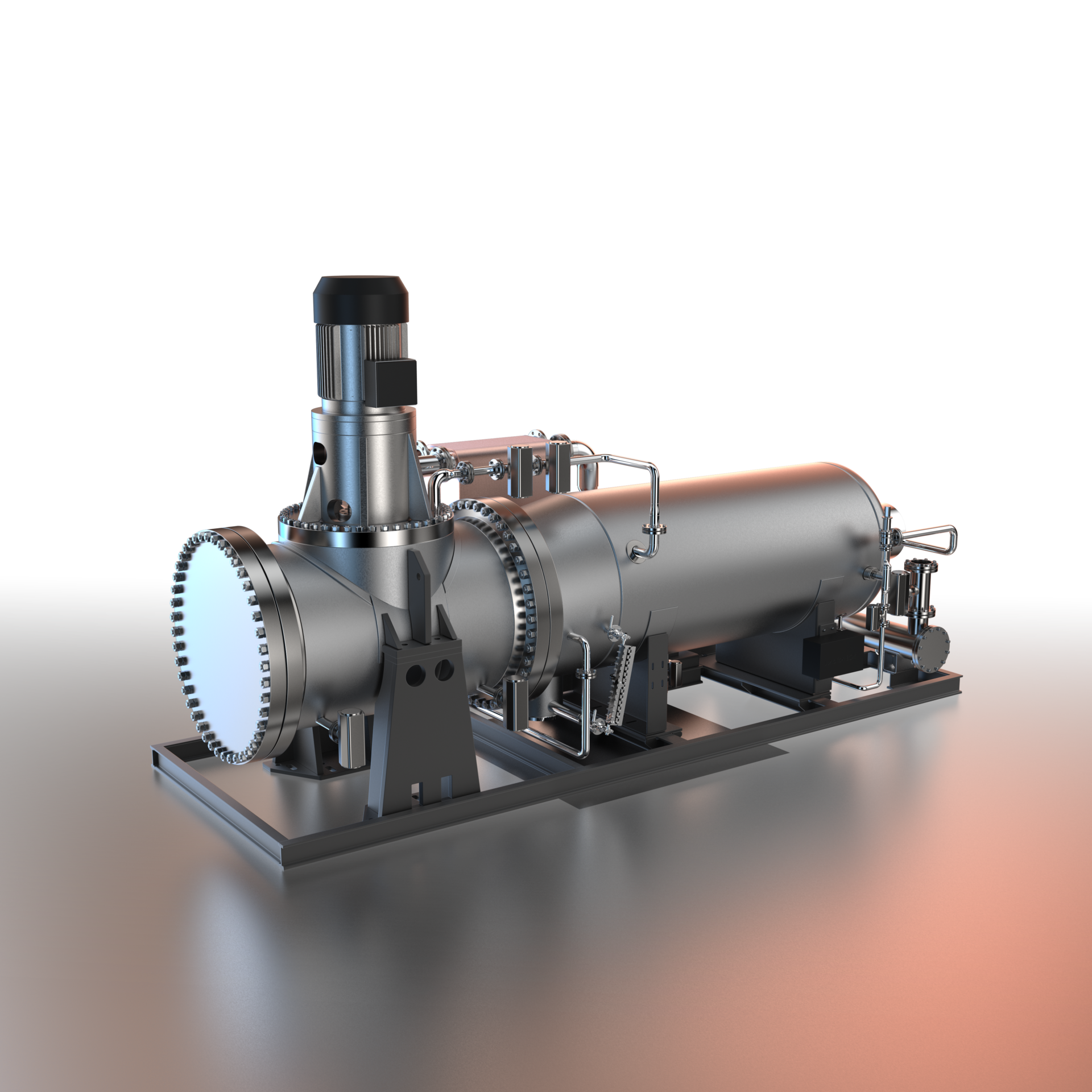

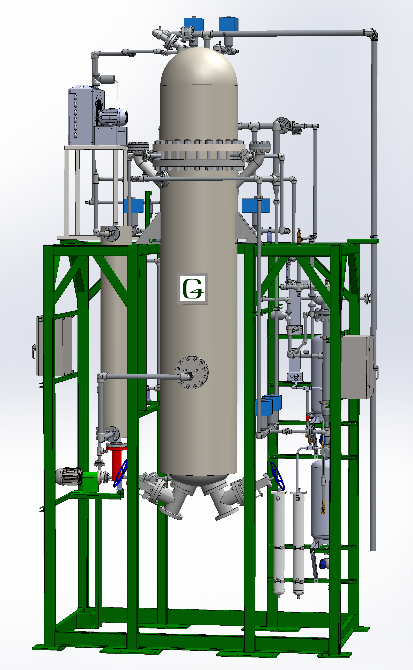

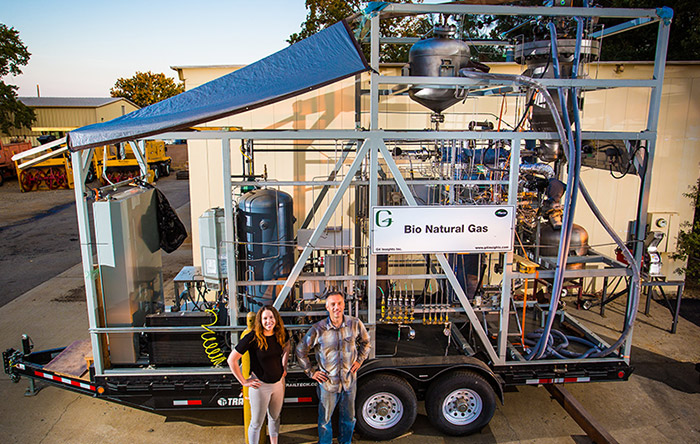

This evolutionary leap is opening a new frontier in which the Canadian ecosystem is starting to reach a critical mass and attracting investors as the premier destination to build and grow high impact companies. For example, NGIF Cleantech Ventures made an equity investment in Software-as-a-Service provider Validere Technologies. With offices in Calgary and Toronto, Validere attracted interest from lead investor Mercuria and a syndicate of established Silicon Valley venture capital funds including Wing Venture Capital and Greylock Partners all of which invested alongside NGIF Cleantech Ventures. As another example, NGIF Cleantech Ventures made an equity investment in Vancouver based industrial-scale hydrogen production company Ekona Power. Again, the round garnered attention from a hugely impressive international coalition of strategic investors including Baker Hughes, Mitsui, ConocoPhillips, TransAlta, Continental Resources, and BDC Capital.

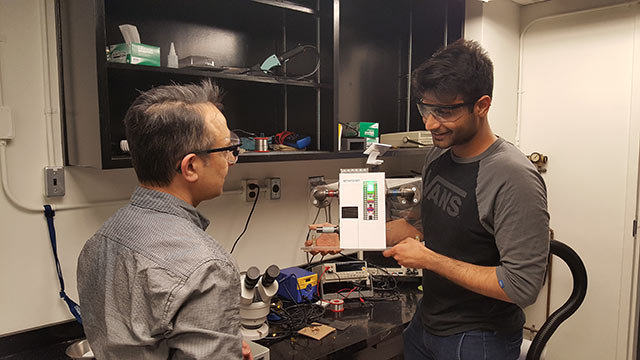

NGIF Cleantech Ventures recognizes the talent and passion of Canadian entrepreneurs. The Fund is well positioned to continue investing in future multi-billion dollar companies that are coming out of this generational change in Canadian innovation.

Based on research conducted by Ilya Strebulaev and his team at the Venture Capital Initiative at the Stanford Graduate School of Business, Canada is one of the most dominant jurisdictions outside of the United States for Unicorn company (a private company valued in excess of $1Bn) founders to call home. On a population adjusted basis, the Canadian scale up ecosystem is second only to Israel outside of the US – and for good reason. Canada’s friendly immigration policies, affordable access to post secondary education, and a high standard of living have all contributed to a wave of category defining heavyweights. Just in the past year,

Based on research conducted by Ilya Strebulaev and his team at the Venture Capital Initiative at the Stanford Graduate School of Business, Canada is one of the most dominant jurisdictions outside of the United States for Unicorn company (a private company valued in excess of $1Bn) founders to call home. On a population adjusted basis, the Canadian scale up ecosystem is second only to Israel outside of the US – and for good reason. Canada’s friendly immigration policies, affordable access to post secondary education, and a high standard of living have all contributed to a wave of category defining heavyweights. Just in the past year,