Preamble

NGIF Capital introduced its 1st of kind investment fund, ‘Cleantech Ventures’, to the market to increase the environmental performance of natural gas. As an industry-led venture fund, it has eight Canadian energy company limited partner investors, each with world-class assets. We leverage the intelligence of our investors in a number of ways. One way is through our Operator Market Intelligence (OMI) days, an engagement strategy conceived as a way to plug into the collective ‘hive mind’ of the nearly 20,000 SMEs from across NGIF’s eight limited partner investors. Through our OMI days, we leverage the expertise of these investors in collaboration with subject matter experts from academia, government, and industry to share knowledge and foster discussion. This promotes a better understanding of the technological developments, market trends, and regulatory frameworks that influence the cleantech landscape where we invest. With that objective in mind, on May 30th, NGIF Capital called to order its inaugural OMI day at our office in Calgary.

Twenty-five stakeholders from Birchcliff Energy, TC Energy, Fortis BC, Tidewater Midstream, Tourmaline Oil, and Apex/TriSummit Utilities gathered in the fit-for-purpose classroom. Invited 3rd party experts included individuals from Columbia University, the University of Calgary, Innotech Alberta, Carbon Management Canada, and Emissions Reductions Alberta. Together, this dynamic group deliberated on the opportunities and challenges facing commercial-scale Carbon Capture Utilization and Storage (CCUS) in the natural gas value chain. Below is a summary of our findings during this half-day event.

OMI Key Messages

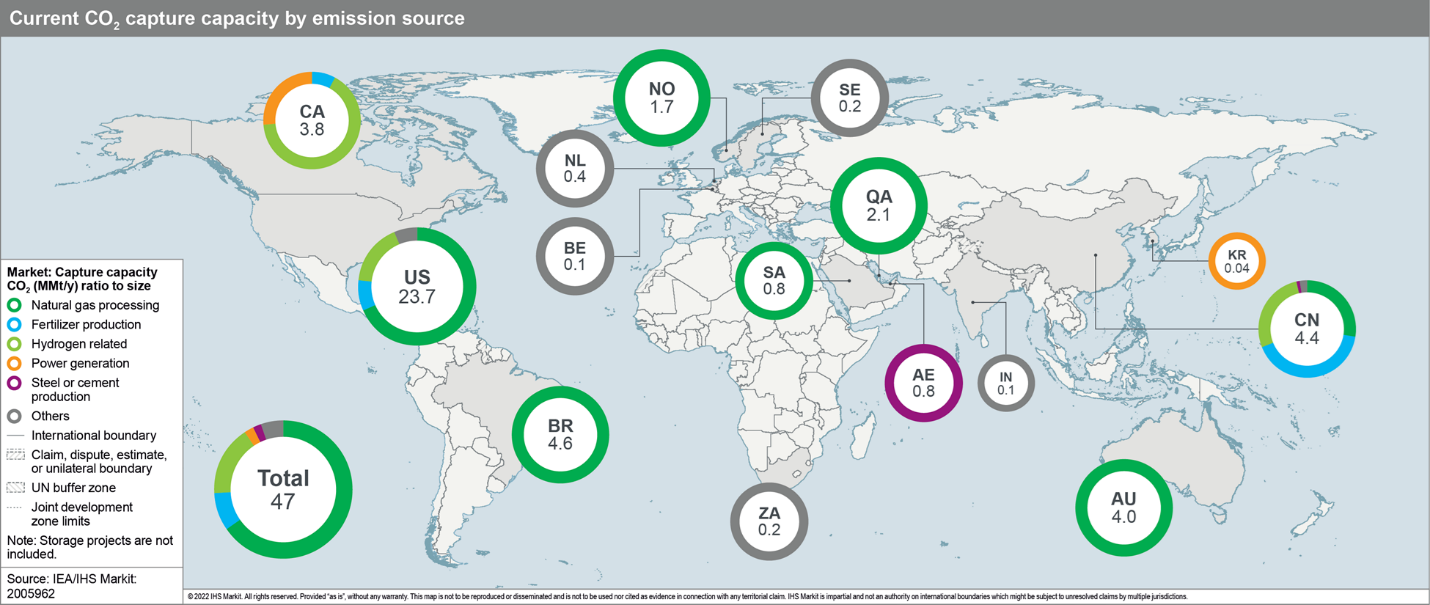

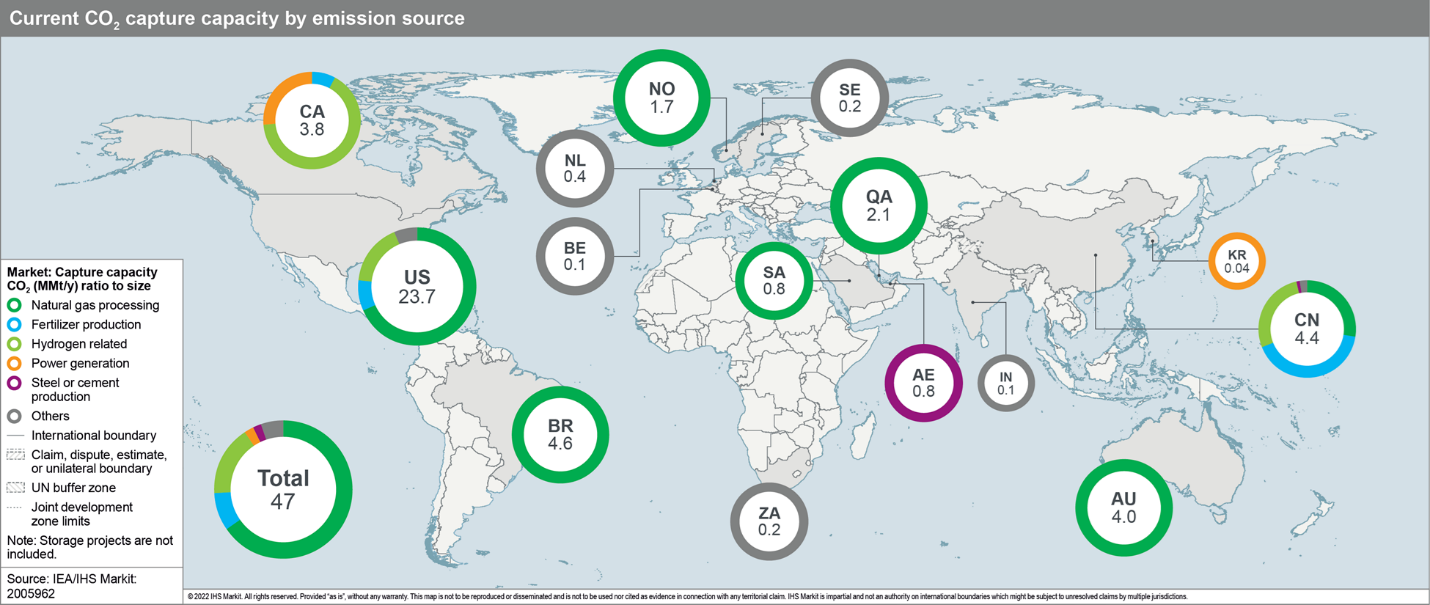

- Canada continues to punch above its weight in installed CCUS capacity. As of 2022, according to data collected by the IEA and IHS Markit, Canada has 8% (3.8MMt/year) of the total 47MMt/year installed CCUS capacity globally.

- The vast majority of Canada’s CCUS capacity is utilized for hydrogen production (~70%), power generation (~25%), and fertilizer production (~5%). Historically, very little of Canada’s CCUS capacity has been used in natural gas processing.

- The absence of post-combustion CCUS in the natural gas value chain has largely been attributed to various types of emission sources that are spread out across an asset base, which are often in remote locations.

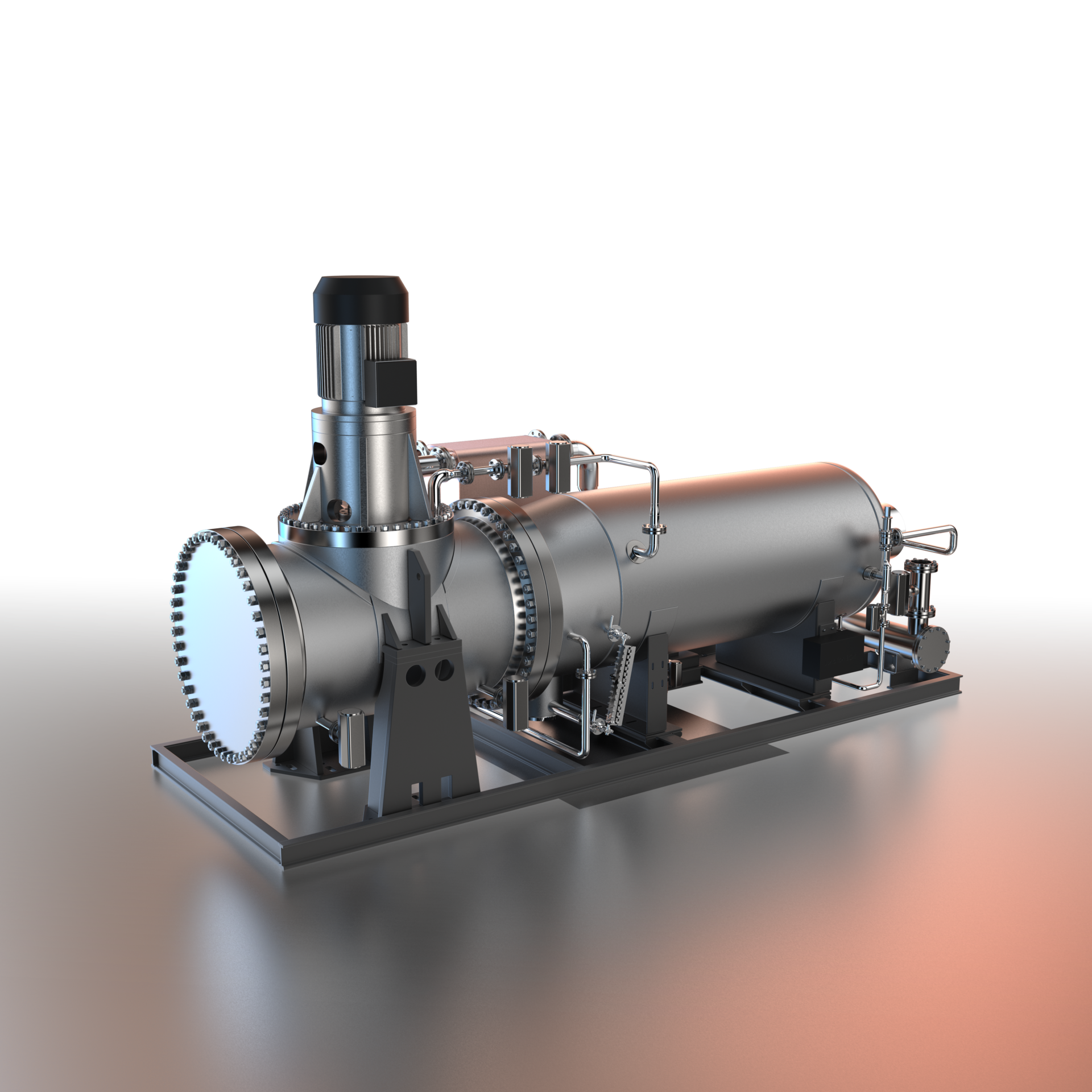

- For example, a midstream company might have compressors (20k tonnes CO2/year), gas turbines (140k tonnes CO2/year), and boilers (180k tonnes CO2/year) spread across provinces, countries, or even continents.

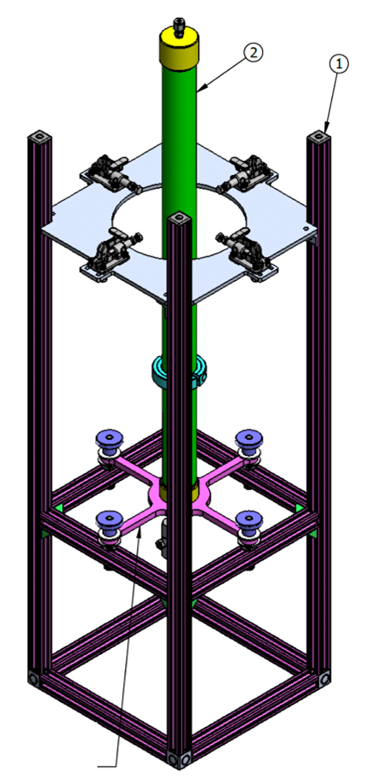

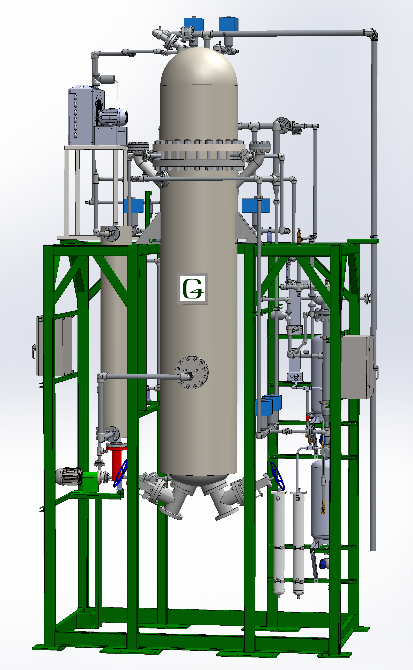

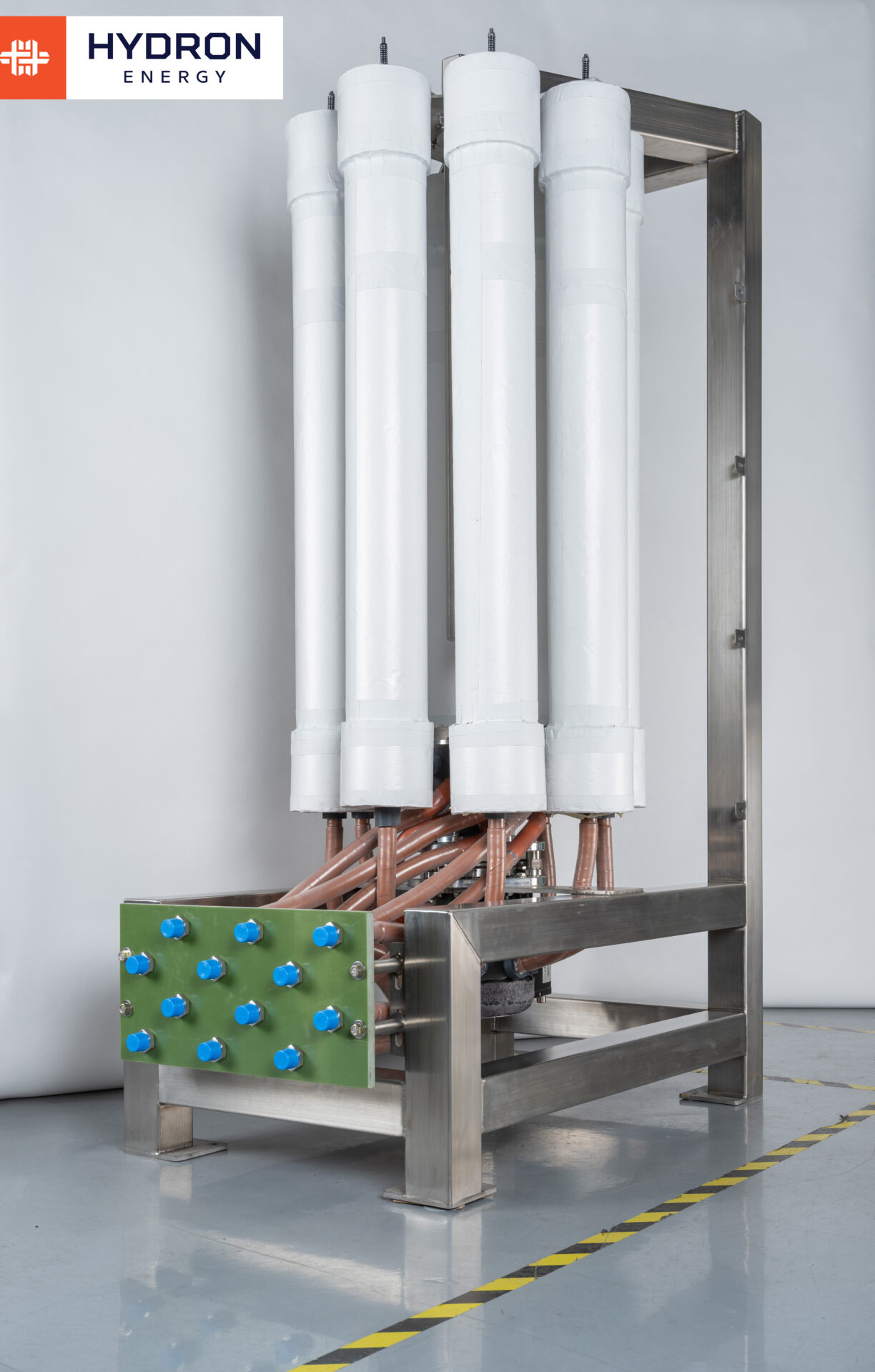

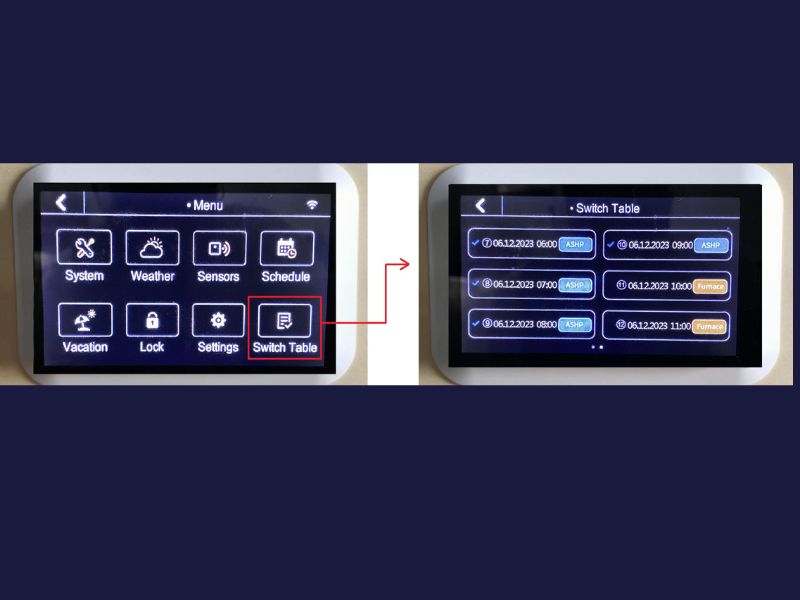

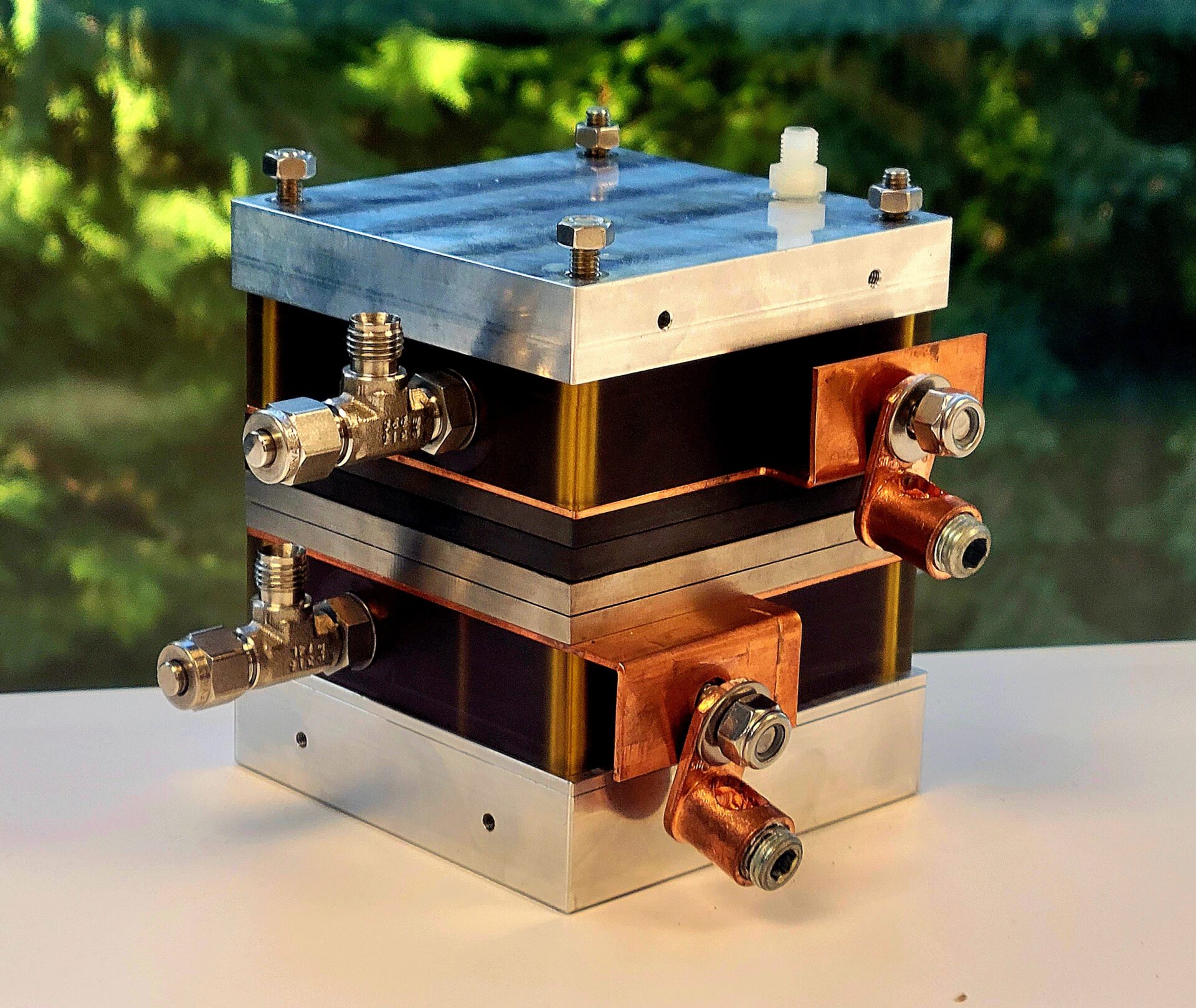

- As a potential solution, many participants highlighted the need for “plug and play” small modular carbon capture technologies, such as Ionada, that provide turnkey module units that do not require extensive retrofitting of existing assets. These small-scale units are specifically designed to drop into brownfield projects where there is low-density CO2 to capture in relatively small volumes (<20,000 tonnes CO2/year).

- Dual tailwinds are acting as catalysts for CCUS in Canada and are encouraging early adoption of the technology: escalating carbon prices and Federal cleantech incentives.

- Despite the lure of economical carbon capture on the horizon, the primary challenge facing participants in the natural gas industry without centralized emission source points is the utilization and storage aspect of carbon capture.

Potential Challenges and Opportunities

- Capture is the expensive part of CCS, and storage is the uncertain part, and without places to store captured carbon, CCS on a commercial scale will be difficult.

- Certain geological formations throughout the WCSB offer a potential avenue to store captured carbon. However, these formations are not necessarily located where carbon is produced. The Leduc Reef, as an example, has good storage potential but is not within close proximity to the storage needs of natural gas participants.

- Heavily fractured formations, such as the Montney, where large volumes of natural gas are produced, no longer have the geologic integrity for long-term carbon storage potential.

Final Thoughts

- NGIF Capital and its investment fund, Cleantech Ventures, see CCUS investments as a pathway to a lower carbon intensity natural gas molecule and building the industry’s market share of cleaner natural gas.

- Canada has produced some world-class CCUS technology companies, including Carbon Engineering, Svante, Carbon Upcycling Technologies, Ionada, and Dark Sky – which collectively have raised nearly CDN$1bn in funding.

- This mirrors the meteoric rise in the number of CCUS startups globally since 2015. Between 2015 and 2022, there was a 63% CAGR in Carbon Capture startups, with nearly half of all venture capital dollars flowing into Direct Air Capture (DAC) technologies.

- DAC technologies remain relatively high cost (CDN$170+/tonne CO2) and are typically suited for warm climates but offer the potential to help decarbonize decentralized emission points.

- Clearer regulatory frameworks, taxes, and government incentives are helping to drive the adoption of CCUS technologies. Canada has shown encouraging progress with carbon pricing and investment tax credits but lags behind more established jurisdictions, such as the United States, with respect to the Federal incentives offered.

- Within the Inflation Reduction Act, the US Federal government increased the 45Q CCUS tax credit. This change increased the minimum for eligible projects to USD$60/tonne (up from USD$35) for utilization from industrial and power generation and raised the maximum to USD$180/tonne (up from USD$50) for storage in saline geologic formations from DAC.