CALGARY, AB (JUNE 08, 2023): NGIF Capital Corporation (NGIF Capital), a Canadian venture capital firm investing in cleantech innovation in the gaseous energy sector, today announced the publication of its inaugural Cleantech Ventures Fund I Performance Report for 2022. In this report, John Adams, Managing Partner at Cleantech Ventures Fund I, speaks on the key milestones it has achieved over the past year including: completing the final close of NGIF Cleantech Ventures Fund I with $55MM in committed capital, welcoming Ekona, Kinitics, Validere, Westgen, and ARIX into the portfolio in 2022 – and seeing a total of $200MM+ in capital raised by its portfolio companies.

Adams noted that “For the first time in history, we have seen meaningful government policies such as the Inflation Reduction Act and the Clean Technology Investment Tax Credit create substantial tailwinds to accelerate the commercialization of energy technologies that lower emissions.” In 2023 and beyond, NGIF looks to build off this momentum and continue investing in clean technologies and laser-focused management teams to increase the environmental performance of the natural gas value chain.

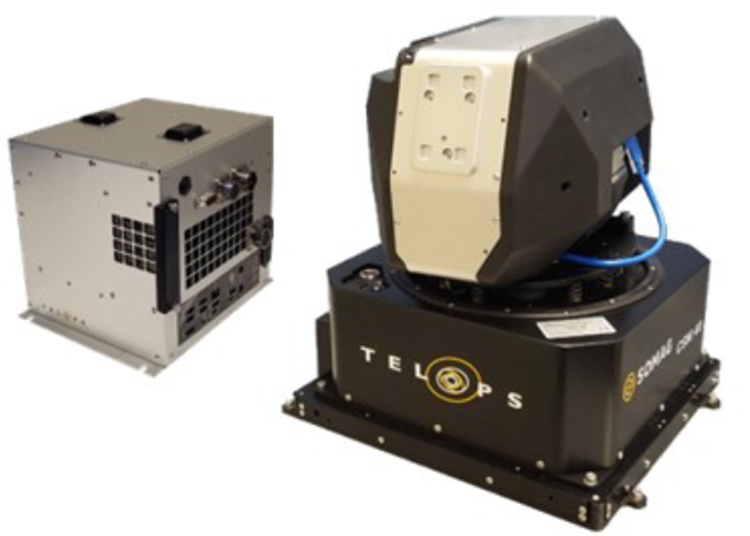

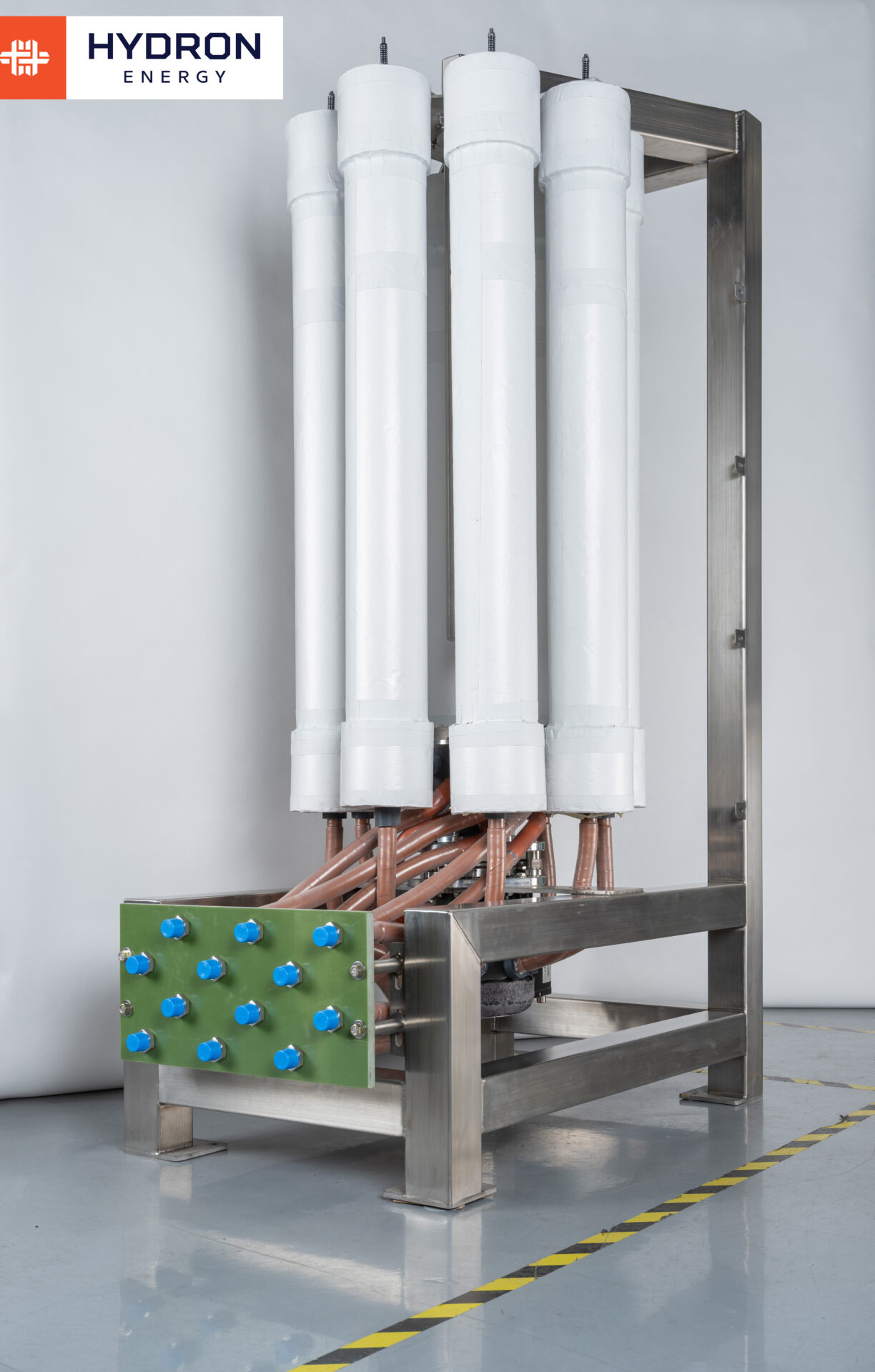

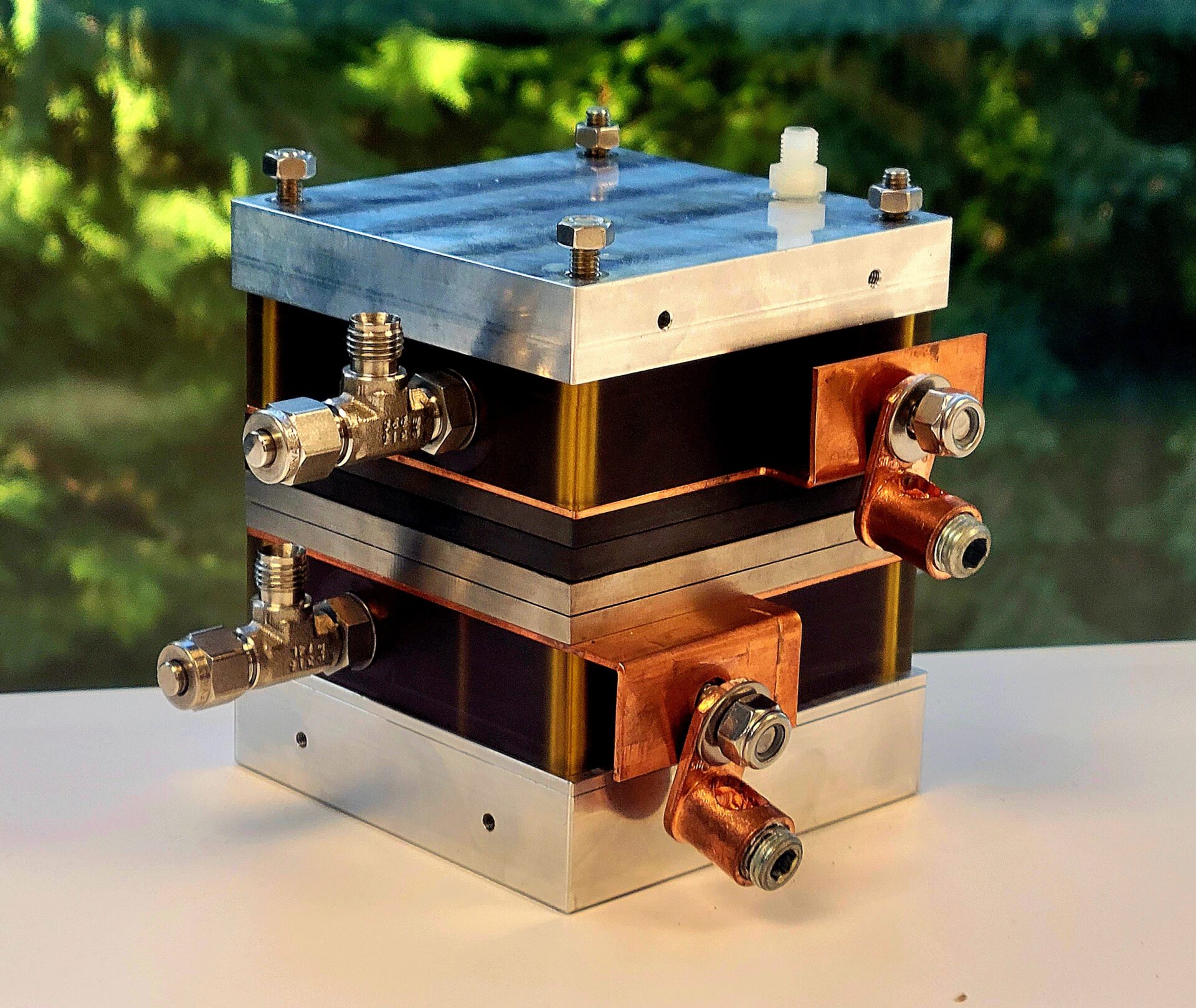

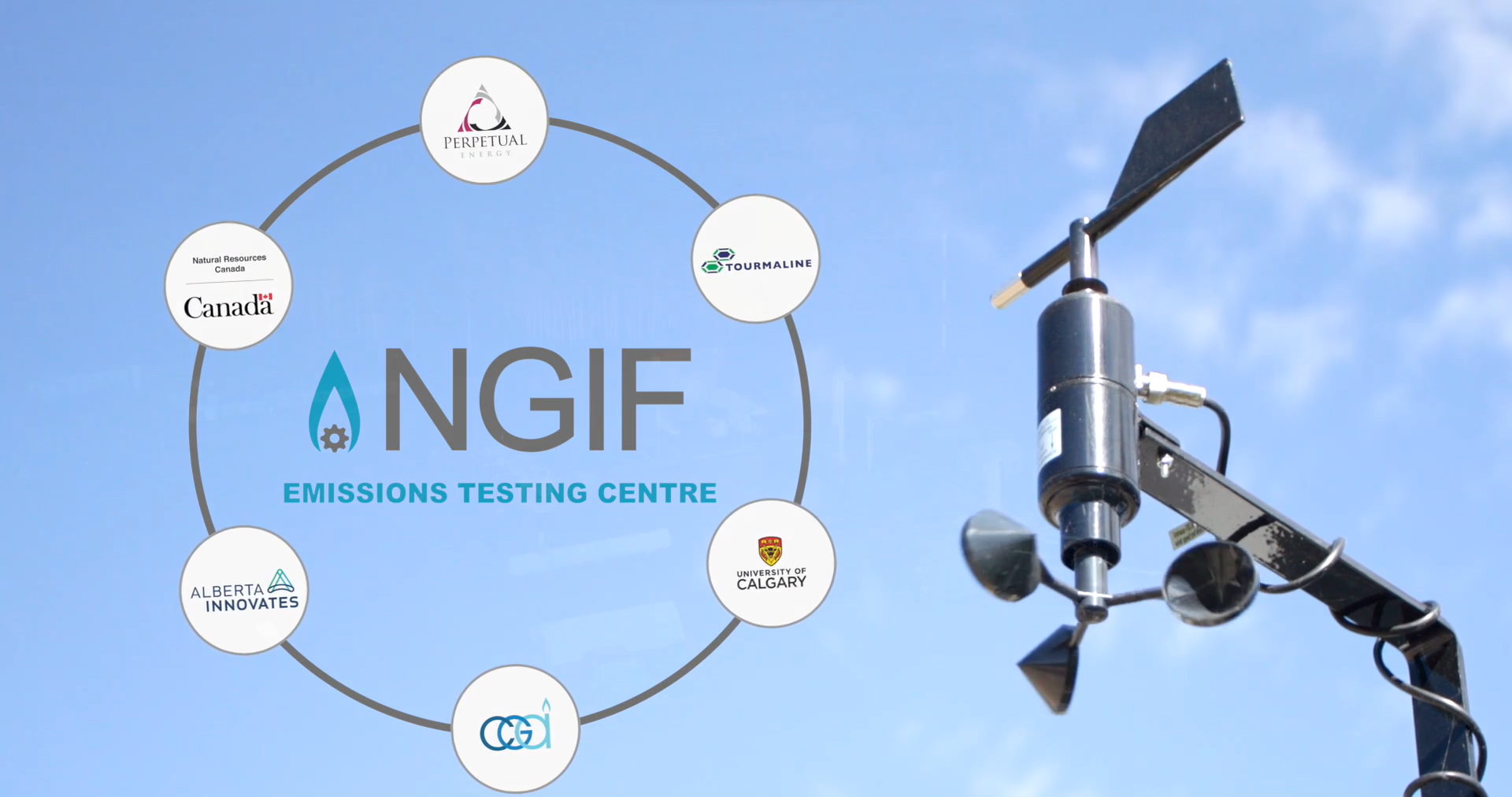

Our Cleantech Ventures Fund I continues to invest in startups with solutions in methane emissions management, carbon capture utilization and storage, energy efficiency, hydrogen, RNG (Renewable Natural Gas), industrial water management, and software solutions. Our environmental performance goal is to reduce GHG emissions, air criteria contaminants, freshwater use, and minimize land disturbance.

We are encouraged by the results outlined in this report and will continue to make investments to increase our gas industry’s performance. Our strategic energy investors supply and distribute the world’s lowest emission molecule to Canada and the world to meet their energy needs. Adams closed with, “As the demand for Canada’s natural gas continues, we will support our industry by bringing cleantech solutions to market. Now more than ever, natural gas has a critical role to play in energy security and reliability.”

About NGIF Cleantech Ventures

NGIF Cleantech Ventures is a $55 million industry-led venture capital fund that makes equity investments in early-stage startups operated by NGIF Capital. The objective of the fund is to grow cutting-edge clean technology companies into commercial-scale enterprises. The fund primarily invests in companies that provide solutions that lead to emissions reductions and other environmental benefits. These solutions are typically focused on existing natural gas production, transmission, distribution, storage, and end-use applications, as well as increased production of renewable natural gas and hydrogen.

For more information, please visit Cleantech Ventures – NGIF Capital

Fund Information:

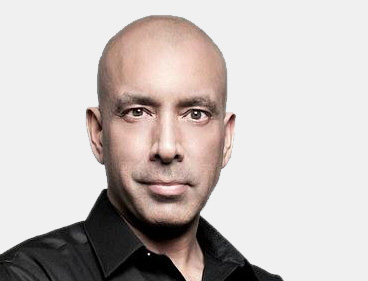

John Adams

President and CEO, NGIF Capital Corporation

Managing Partner, NGIF Cleantech Ventures

613-748-0057

jadams@ngif.ca

Media Information:

Dini Philip

Communications Coordinator, NGIF Capital Corporation

(403)-389-2090

Dphilip@ngif.ca